Introduction

Investing in the stock market offers amazing opportunities, but it can be difficult, especially for beginner. One term that often confuses investors is ASBA short for “Application Supported by Blocked Amount. In this blog, we’ll simplify ASBA, explaining its workings, benefits, application process, eligibility criteria, and its significance in the investment landscape.

Table of Contents

ToggleWhat is ASBA account

Application Supported by Blocked Amount, is a unique system used during Initial Public Offerings (IPOs) and Follow-on Public Offers (FPOs) in India. This innovative approach allows investors to apply for shares without the need to transfer funds upfront, providing an easy and safe way to participate in these offerings.

How ASBA Works

its works on a simple idea: your application funds stay safely blocked in your bank account until the allotment process concludes. If your application is successful, the required funds are automatically debited, and you receive your allotted shares. If not, the blocked amount is quickly released back to your account. This process ensures that your money is used only when necessary, offering peace of mind and enhancing the IPO or FPO experience.

Benefits of ASBA

1. No Need to Transfer Funds Upfront: its eliminates the need to transfer funds in advance, allowing you to retain control over your money until share allotment.

2. Interest Earned: Your funds continue to accrue interest in your account, potentially increasing your returns.

3. Streamlined Process: its reduces paperwork and simplifies the application process, making it accessible to a wider range of investors.

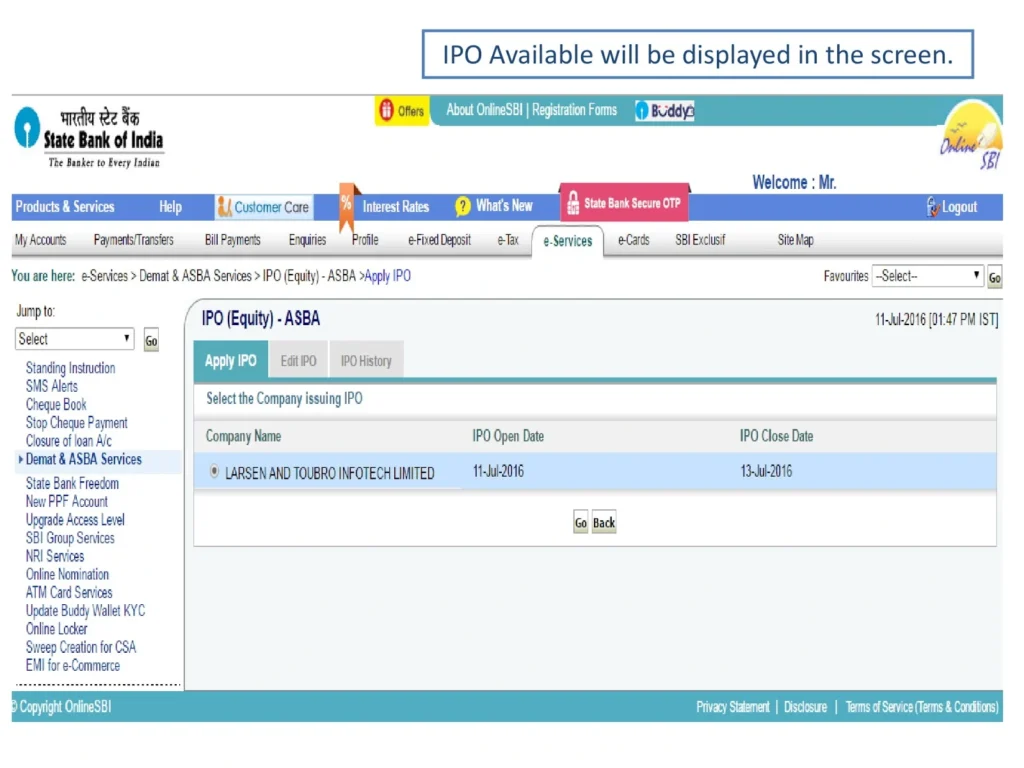

How to Apply for ASBA

Eligibility Criteria for ASBA

While ASBA is generally available to both retail and non-retail investors, certain conditions may vary among banks. Typically, you need a savings or current account at a bank offering ASBA services, a valid PAN card, and a Demat account to apply for shares using ASBA.

Conclusion

ASBA is a valuable tool that simplifies the process of applying for shares in Indian IPOs and FPOs, enhancing the convenience and efficiency of investments. By allowing your funds to remain in your account until share allotment, ASBA offers financial flexibility and improves your investment experience. Make sure to check with your bank for specific ASBA processes and eligibility criteria before participating in this unique offering.

Frequently asked question

Application Supported by Blocked Amount

If you’re not allotted shares, the blocked amount is unblocked, and you regain access to those funds in your bank account.

Yes, you can modify or withdraw your ASBA application as long as it’s done before the IPO’s closure date.

Many banks offer ASBA services for free, but it’s advisable to check with your bank for any applicable charges.

Yes, ASBA can be used for both physical and online IPO applications, providing flexibility to investors.

I have to thank you for the efforts you have put in writing this blog. I really hope to see the same high-grade blog posts from you in the future as well. In fact, your creative writing abilities has motivated me to get my very own blog now 😉