introduction

In the world of business growth, an Initial Public Offering (IPO) marks a big step. It helps companies get money by selling shares to the public. In India, the IPO process is guided by SEBI, a regulatory body. It has many steps and rules.

Understanding these is important for companies going public, potential investors, and financial experts. In This blog will explain the complex IPO process in India, from creating documents to getting listed on the stock exchange.

Table of Contents

ToggleWhy IPO process important

Going public is important for companies wanting more money and a bigger reach. It lets them get funds from various investors, including institutions, funds, and individuals. This helps both the company and its private investors.

An IPO also boosts a company’s reputation, attracting more customers, partners, and skilled workers. Being public sets the stage for growth, benefiting both the company and its investors.

Even though public companies have to follow rules, the benefits of access to capital markets and increased visibility make it useful.

Understanding the process IPO in India

The IPO process in India is a complex journey with many legal requirements. Let’s break down the stages of launching an IPO in India.

Stage 1: Hiring an Investment Bank

The first step in an Indian IPO is hiring an investment bank or a group of underwriters. Usually, a company works with multiple banks to plan their IPO. These underwriters have many roles, including financial analysis, asset evaluation, and deciding how much money to raise. They make an agreement that outlines the terms, including how much money to raise and what kinds of securities to offer. It’s important to note that underwriters share the risk of raising capital.

Stage 2: Creating Documents and Registering with SEBI

After hiring an investment bank, the next step is creating the Red Herring Prospectus (RHP) and registering with SEBI. The RHP is like a preview of the prospectus. It has information about the company’s finances, managers, strategies, and risks. The name “Red Herring Prospectus” suggests that it’s not final and could change.

The RHP and the registration statement must be submitted to SEBI, following the Companies Act. The registration statement explains details like the securities to be issued and how the raised money will be used.

Before the public bidding phase, the company submits these documents to the Registrar of Companies (ROC). SEBI checks them for complete and clear information. If there are issues, the company must fix them before reapplying.

Stage 3: Applying to the Stock Exchange

Once SEBI approves the RHP, the company can apply to the stock exchange where they want to list their shares like NSE & BSE. This process involves a lot of paperwork, including prospectus copies and other documents. The stock exchange reviews the application and decides whether to approve it.

Stage 4: Going on a Roadshow

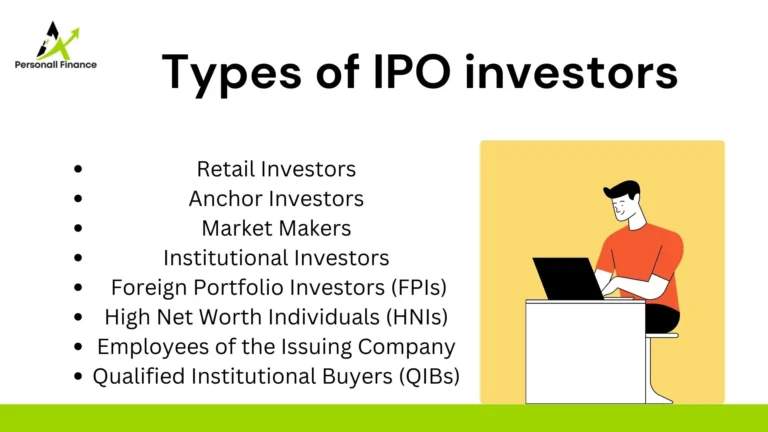

Before the IPO is public, there’s a two-week roadshow. Company executives travel to financial hubs to meet potential IPO investors, especially Qualified Institutional Buyers (QIBs). The goal is to generate interest in the IPO by presenting data about the company’s growth and profitability. The roadshow also targets institutional investors like mutual funds and wealthy individuals. Sometimes, the company offers shares to popular groups at a special price before the public listing to raise more capital.

Stage 5: Setting the IPO Price

After the roadshow, the company decides the IPO share price. They can use two methods:

1. Fixed Price Method: This method sets the share price based on factors like liabilities, capital goals, and demand.

2. Book Building Method: This method sets a price range based on investor bids, with the final price determined by demand. The final price can be up to 20% higher than the initial range. Issuers often prefer this method for better price discovery.

Stage 6: Opening to the Public

After the roadshow and price decision, the IPO becomes available to the public. IPO forms are announced on a specific date and can be obtained from designated banks or brokers. Investors fill out the forms online and offline and submit them with payment. SEBI allows a three-working-day window for public access to IPO application forms.

Choosing the right time for the IPO is important to avoid competing with bigger companies.

Once the IPO bidding period ends, the company submits the final prospectus to the Registrar of Companies (ROC) and SEBI. This prospectus includes share allocations and the final issue price.

Stage 7: Executing the IPO

Once the IPO price is set, stakeholders and underwriters allocate shares to investors. Investors usually get their full share unless there’s oversubscription. Shares are then added to their demat accounts. In oversubscribed cases, refunds are issued. It’s important to follow SEBI rules during allocation.

The allocation process happens within ten days of bidding. After allocation, the IPO starts trading in the stock market.

Conclusion

The IPO process in India might be complex and take time, but it’s a way for companies to get money and for investors to invest in them. Companies need to carefully evaluate their finances, strategies, and the market. Investors also need to research and assess a company’s prospects before investing. When done right, an IPO can lead to growth and investment opportunities in the Indian economy.

Frequently asked question

IPO shares are typically allocated to institutional investors, high-net-worth individuals, and retail investors. The allocation process varies by jurisdiction and is usually overseen by the underwriters.

The lock-up period is a restriction on the sale of shares by company insiders, such as executives and early investors, for a specified period after the IPO. It prevents immediate selling, which could flood the market and depress the stock’s price.

IPO investments carry several risks, including market volatility, limited historical data, and the potential for overvaluation. It’s essential for investors to conduct thorough research before participating in an IPO.

Yes, retail investors can participate in IPOs. Some IPOs allocate a portion of shares specifically for retail investors, while others allow retail participation through brokerage accounts.

The costs of an IPO include underwriting fees, legal and accounting fees, regulatory filing fees, and marketing expenses. These costs can be substantial and should be factored into the decision to go public.