Introduction

Portfolio management services, often referred to as PMS, are specialized investment management services offered in the financial markets. The service is specifically designed to meet the specific needs and preferences of investors.

PMS is an effective way to achieve financial goals while minimizing risks and maximizing returns. In this blog, we’ll look into the intricacies of PMS, explore the types of investments, and point out the many benefits it offers investors.

Table of Contents

TogglePortfolio management services

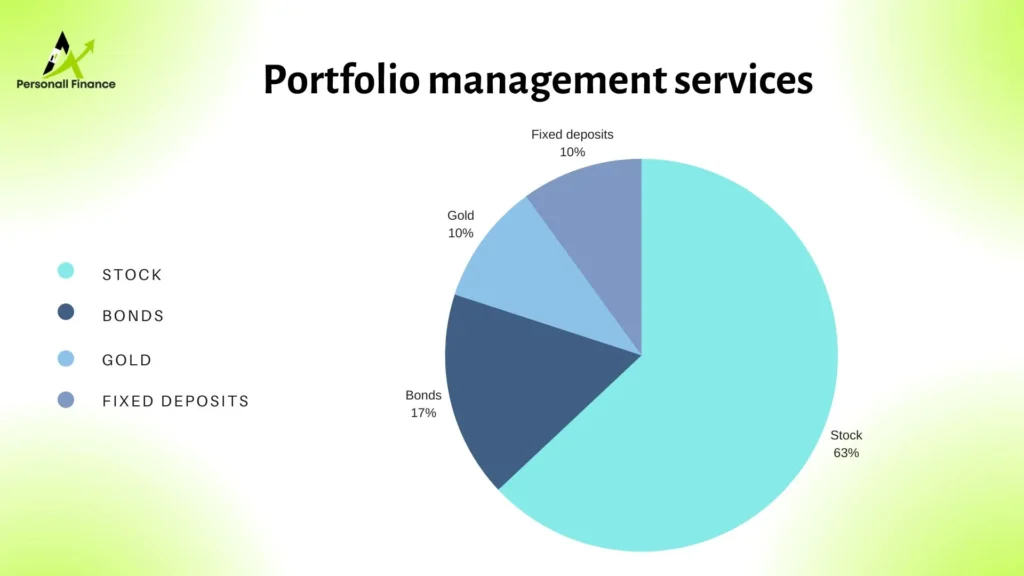

Portfolio Management Services (PMS) is a complete investment solution offered by professional portfolio managers and investment experts. It offers individual investors the opportunity to build a diversified portfolio of stocks, bonds, and other financial instruments, all managed by experts who make investment decisions on their behalf.

Types of PMS

There are 4 common types of PMS investments.

Active Portfolio Management:

The manager aims to maximize your profits by diversifying your investments across different areas. They frequently make changes to reduce risk. It’s more active but can yield higher returns.

Passive Portfolio Management:

This method sticks to preset investment plans based on the market’s current direction. Managers often choose index funds, which grow slowly with minimal adjustments. They have low activity but provide decent long-term gains.

Discretionary Portfolio Management:

In this approach, the manager takes charge of your portfolio. They pick a strategy that fits your goals, your risk comfort, and how long you want to invest. For example, they might suggest stocks for a risk-taker and bonds for a careful investor.

Non-Discretionary Portfolio Management:

Here, the managers offer advice, but you have the final say. Once you agree, they make the moves according to your decision.

Benefits of portfolio management services?

Investing in a PMS offers several benefits:

1. Professional Expertise: It provides access to experienced investment experts who have expertise with market trends and can make informed investment decisions.

2. Customization: It allows personalized investment strategies specific to individual financial goals and risk tolerance.

3. Diversification: Diversification across different asset classes reduces risk and increases returns.

4. Active Management: its provides active portfolio management, ensuring that investments are adjusted according to market conditions.

5. Transparency: Investors can access regular reports and statements, providing complete transparency about their investments.

6. Liquidity: Its provide liquidity, allowing investors to access their funds as needed.

Conclusion

Ultimately, portfolio management services provide investors with an effective way to navigate the complex world of finance. With professional expertise, customization, and diversification, it is a valuable tool for those looking to achieve their financial goals while minimizing risk. If you prefer active or passive involvement in your investments, a PMS can be tailored to meet your needs and bring financial success

Frequently asked questions

Portfolio Management Services.

Yes, it can be a good investment option for individuals who seek personalized and professional management of their investment portfolio.

In India, the minimum investment amount for PMS starts at Rs 50 lakhs, according to SEBI guidelines.