Introduction

The full form of XIRR is “EXtended Internal Rate of Return,” which is an important concept in the world of finance and investments, particularly when it comes to mutual funds.

It helps investors measure how well their mutual fund investments are performing. But what exactly does XIRR mean, and how can you determine whether your mutual fund has a good XIRR? Allow me to explain it simply.

Table of Contents

ToggleXIRR Meaning

XIRR is like a measuring tool for mutual fund investments. It tells you how much money you’re making or losing over time. It’s like keeping an eye on your mutual fund’s progress. A higher XIRR usually means your investment is doing well, while a lower XIRR might indicate that it’s not performing as expected.

What Is a Good XIRR in Mutual Funds?

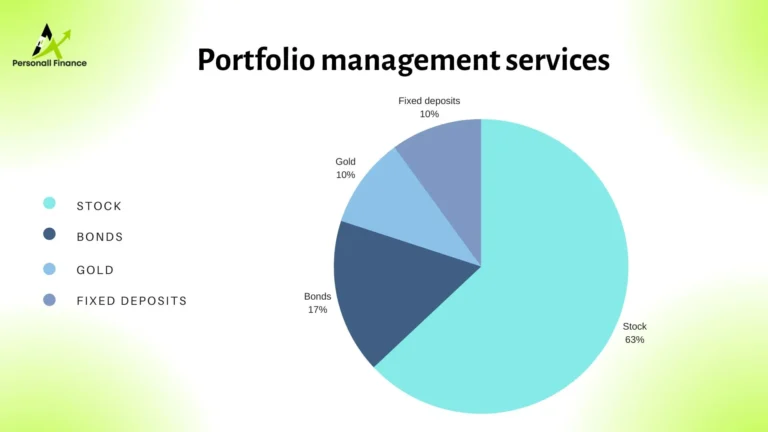

Now, you might wonder, what’s a “good” XIRR? Well, there’s no one-size-fits-all answer because it depends on your goals and risk tolerance. But generally, a good XIRR is one that’s higher than what you could get from safer investments like a fixed deposit. For example, if a fixed deposit gives you a 6% return, a good XIRR for a mutual fund might be 12% or more.

How to Calculate XIRR:

A financial calculator, spreadsheet software, or specialized financial tools are required to calculate XIRR. You must possess the following knowledge:

1. The dates of your investments and withdrawals

2. The corresponding cash flows for each date

How to calculate XIR in Excel

1. Organize your data with dates in one column and corresponding cash flows in another.

2. In an empty cell, use the XIRR formula, which typically looks like this: `=XIRR(cash flows, dates)

3. Press Enter, and the cell will display the XIRR value.

XIRR will provide you with the annualized rate of return based on your cash flows. A positive XIRR indicates positive returns, while a negative XIRR suggests losses.

Conclusion

In conclusion, XIRR is a valuable tool for mutual fund investors to assess the performance of their investments. Understanding XIRR, what constitutes a good XIRR, and how to calculate it can help you make informed decisions about your mutual fund portfolio. Keep in mind that XIRR should be evaluated in the context of your investment goals and risk tolerance.

Frequently asked question

EXtended Internal Rate of Return

Regular IRR is for when you invest money in a simple way, but XIRR is for when you put money in and take it out at different times and amounts. XIRR is more flexible and better for real-life investments.

A positive XIRR means your investment is making money. You’re gaining more than you started with.

Yes, its works for all kinds of investments like stocks, bonds, or real estate. It’s handy when your investment behavior is not regular.